What's the Impact of Presidential Elections on the Housing Market?

Posted by Shane Andersen on

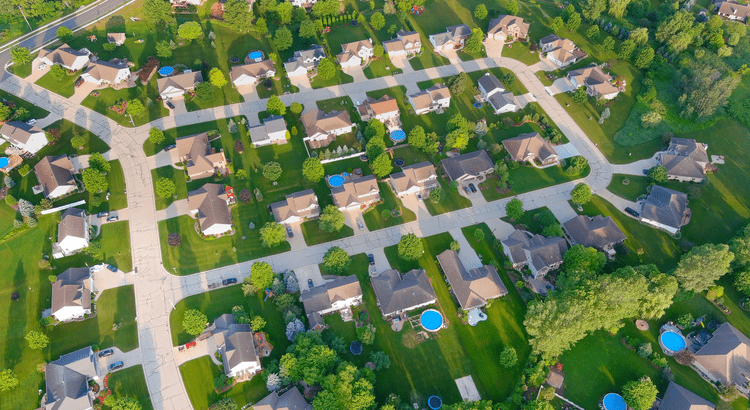

It’s no surprise that the upcoming Presidential election might have you speculating about what’s ahead. And those unanswered thoughts can quickly spiral, causing fear and uncertainty to swirl through your mind. So, if you’ve been considering buying or selling a home this year, you’re probably curious about what the election might mean for the housing market – and if it’s still a good time to make your move.

Here’s the good news that may surprise you: typically, Presidential elections have only had a small, temporary impact on the housing market. But your questions are definitely worth answering, so you don’t have to pause your plans in the meantime.

Here’s a look at decades of data that shows exactly what’s happened to home sales, prices,…

229 Views, 0 Comments